Graduation 2020!

Dear Margaret,

We are now almost 6 months into working remotely. All in all, I can’t complain as Roger and I have the necessities and comfort of life and I’m still able to work as if we were in the office. We, like most, are restricting our social encounters and hunkering down mostly at home. Like many, we had a scare, got tested for COVID 19, and quickly learned our results were negative.

The past few months have not been so kind to America’s children. They are coping with losing months of education, not participating in sports, and not being able to start or finish college as planned. What we are learning is that though the COVID-19 pandemic is proving most deadly for older Americans, these same people are coping better than younger generations with the challenge, both psychologically and financially.

I think of my grandson, Kailee (Kai) Hashimoto, who just graduated from high school. 2020 started out as a great year for him…anticipating all the fun in his high school senior year. He was anxiously waiting for college acceptance to top film schools. At the same time, his short documentary had been accepted to the South by Southwest film festival (SXSW). Life was good.

As the pandemic began, SXSW was cancelled…thus the first of his 2020 disappointment. However, he later learned that his documentary won a jury award for his category…and a company paid him $3000 for distribution rights! Just a few weeks later, he learned he was accepted to his two top choices for film school. He chose USC. The future was looking good.

Then, the economy shut down and Kai's school went to remote learning; which meant no senior activities. No party, no prom, no award banquets, no group celebration and barely time to say goodbye and good luck to all his departing classmates. Kids settled for quick drive by parties. Relationships were disrupted. Graduation was deferred until later in July and was held in the football stadium where all could socially distance…even still, each family was only allowed two attendees. While we couldn’t attend Kai’s graduation, we did enjoy the program virtually and saw him march up and receive his diploma. Despite the heat and scorching sun, all were formally dressed.

Kai hopes to be able to start USC on campus in the spring…until then, he’s taking classes remotely.

On a more positive note, Daniel Chapman, the Investment Portfolio Associate for the Starner Group, took working remotely as an opportunity. He managed to take flying lessons, accomplishing a lifelong dream…. to get his pilot license! Below is the picture of Daniel on day he passed his flight exams and qualified.

The plane is a Cessna 172….coincidentally, my first date with Roger (decades ago!) was flying to the Nut Tree in a Cessna 172.

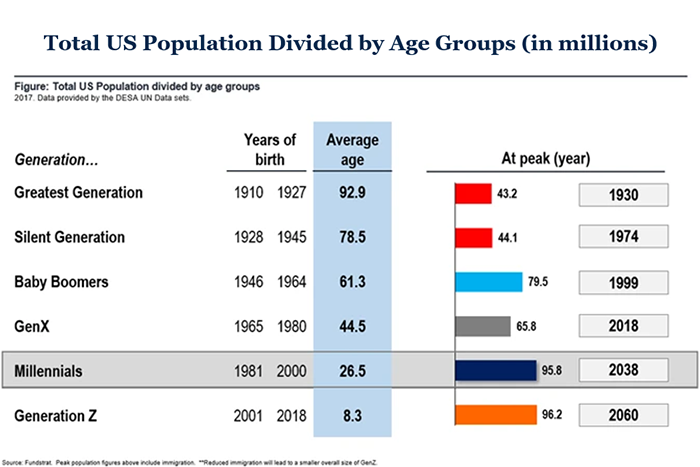

While the progress and accomplishments of Kai and Daniel are important personally, they are also good signs for America’s future, as they are part of the two largest generations that will be extremely impactful to potential growth of the US economy. The chart below is 2 years old but still illustrates the massive difference in size between GenX (Scott and Bruce), the Millennials (Daniel), and Gen Z (Kai).

Both Millennials and Gen Z’s are experiencing unique disruptions to their lives that may be more similar to the Silent Generation, who went thru the Great Depression and WWII. My husband, Roger is part of the Silent Generation - he was drafted into the army while in college and later finished college on the GI Bill. We bought our first home with the GI bill. As an aside, the GI Bill is a remarkable piece of legislation that was created for WW II veterans, which opened the door to opportunities for millions of WWII veterans by offering federal aid to help veterans buy homes, get jobs and pursue an education…..

- Within its first seven years of use, about 8 million veterans took advantage. U.S. college and university degree-holders more than doubled between 1940 and 1950.

- A home loan provision of the GI Bill provided opportunity for home ownership. By 1955, 4.3 million home loans worth $33 billion had been granted to veterans, who were responsible for buying 20 percent of all new homes built after the war.

- The boom had a ripple effect across the economy, warding off any concerns of a new depression and creating unparalleled prosperity for a generation.

Though the Millennials and Gen Z are experiencing major disruptions, I don’t expect either generation to be “silent”. Due to their massive size, I expect they will use these experiences to be impactful to the world… socially, politically, and economically. I also expect that their size implies long term demands and growth for the US economy.

CONGRATULATIONS to all the 2020 graduating classes. I will be very interested in hearing your stories as you enter your college years or starting your careers. And Good Luck too!

As always, please don’t hesitate to contact us with any financial planning questions, or just to chat! And Stay Well!

Sincerely,

Margaret C. Starner

Senior VP - Financial Planning

2333 Ponce de Leon Blvd. Suite 500

Coral Gables, FL 33134

Barron’s is a registered trademark of Dow Jones & Company, L.P. All rights reserved. "Barron's Hall of Fame" is an award honoring a group of advisors who exemplify long-term success and commitment to their clients. Each member of the Hall of Fame has appeared in 10 or more of Barron's annual Top 100 Advisor rankings, and their long-looking commitment to excellence is a hopeful example for the industry to follow. The Top 100 Advisor rankings are based on data provided by individual advisors and their firms and include qualitative and quantitative criteria. Data points that relate to quality of practice include professionals with a minimum of 7 years financial services experience, acceptable compliance records (no criminal U4 issues), client retention reports, charitable and philanthropic work, quality of practice, designations held, offering services beyond investments offered including estates and trusts, and more. Financial Advisors are quantitatively rated based on varying types of revenues produced and assets under management by the financial professional, with weightings associated for each. Investment performance is not an explicit component because not all advisors have audited results and because performance figures often are influenced more by clients’ risk tolerance than by an advisor’s investment picking abilities. The ranking may not be representative of any one client’s experience, is not an endorsement, and is not indicative of advisor’s future performance. Neither Raymond James nor any of its Financial Advisors pay a fee in exchange for this award/rating. Barron’s is not affiliated with Raymond James.

The Forbes ranking of Best-In-State Wealth Advisors, developed by SHOOK Research, is based on an algorithm of qualitative criteria, mostly gained through telephone and in-person due diligence interviews, and quantitative data. Those advisors that are considered have a minimum of seven years of experience, and the algorithm weights factors like revenue trends, assets under management, compliance records, industry experience and those that encompass best practices in their practices and approach to working with clients. Portfolio performance is not a criteria due to varying client objectives and lack of audited data. Out of approximately 32,000 nominations, more than 4,000 advisors received the award. This ranking is not indicative of advisor's future performance, is not an endorsement, and may not be representative of individual clients' experience. Neither Raymond James nor any of its Financial Advisors or RIA firms pay a fee in exchange for this award/rating. Raymond James is not affiliated with Forbes or Shook Research, LLC. Please visit https://www.forbes.com/best-in-state-wealth-advisors for more info.

The Forbes ranking of America’s Top 1,000 Women Wealth Advisors, developed by SHOOK Research, is based on an algorithm of qualitative and quantitative data, rating thousands of wealth advisors with a minimum of 7 years of experience and weighing factors like revenue trends, AUM, compliance records, industry experience and best practices learned through telephone and in-person interviews. Portfolio performance is not a criteria due to varying client objectives and lack of audited data. Research Summary (as of April 2019): 32,000 nominations were received based on thresholds (9,654 women) and 1,000 won. This ranking is not indicative of advisor’s future performance, is not an endorsement, and may not be representative of individual clients’ experience. Neither Forbes nor SHOOK receive a fee in exchange for rankings. Raymond James is not affiliated with Forbes or Shook Research, LLC. Please visit https://www.forbes.com/top-women-advisors/#28abc5bd51f4 for more info.

Nominees for the InvestmentNews Diversity & Inclusion Lifetime Achievement Award must currently be working as financial planners, registered representatives or registered investment advisers, or as industry professionals in a role that supports financial advisers. Judges will consider management, team development, achievement and a minimum 15-year commitment to fostering diversity and inclusion. InvestmentNews received about 130 nominations for the Diversity & Inclusions awards and selected 1 individual for the Lifetime Achievement award. The ranking may not be representative of any one client's experience, is not an endorsement, and is not indicative of future performance. Neither Raymond James nor any of its Financial Advisors pay a fee in exchange for this award/rating nor is Raymond James affiliated with InvestmentNews.