Happy Father's Day, Disney, and Closing Juneteenth

Our office will be closed on

Monday June 19th

in observance of Juneteenth

Today you will hear from Bruce, who has been the “super dad” these past few weeks…celebrating graduations and continuing a fun family tradition that began with his Dad.

Bruce - the Super Fun Dad

The past few weeks have been quite busy, as my daughter, Micaela, graduated from Columbia University, and my son, Cole, graduated from high school. Micaela has begun working for Cisco in their department of Corporate Social Responsibility. Meanwhile, Cole (much to Scott’s joy) is headed to the University of Michigan in the fall.

Micaela graduating from Columbia University

Cole graduating from Village Christian High School

To celebrate, we took a trip to Disney World- a place that always reminds me of my dad – which seems appropriate heading into Father’s Day weekend.

My dad died by heart attack over two decades ago, far too young at the age of 60. In many ways, he was the embodiment of the American Dream. He arrived in the US from Cuba at the age of 15. As his mother had recently died, he lived his with his grandparents in Brooklyn. He learned English while simultaneously attending high school. Even as a child, Dad wanted to build airplanes. After high school, he attended a small aeronautics college in the shadow of LaGuardia airport, before earning his bachelor's at Hofstra University. He was then hired by Grumman Aerospace, and eventually earned his Masters in Engineering from Columbia University while also working full-time.

At the time of his death, Dad had progressed to Chief Engineer for the F/A-18 Hornet, responsible for all engineering related to the plane’s fuselage.

My dad was the hardest worker I ever knew. He literally went to the office 7 days a week, working until 2 PM on Saturdays and noon on Sundays. In his nearly 40 years at Grumman (which eventually became Northrup Grumman), Dad took exactly one sick day – when he left work to come home after I, at the age of six, shattered his beloved 50 gallon fish tank while practicing my baseball swing in the living room. I got a spanking that day!

When I was older, my dad told me that he only got his job at Grumman because he was a “token” hire, so he worked harder than everyone else to be successful.

For whatever reason, Dad believed that Disney represented all that was right with America. Every December, starting in the early 70’s, he would load our family into his orange, VW bug to drive from our house on Long Island to Orlando for a week at the Disney campground. After my parents divorced, the trip was just my brother, dad, and me. Without the good sense of a woman, our 20+ hour drives often devolved into insanity.

Always efficient, my dad was obsessed with “making time” – hence, he generally had a rule that we couldn’t stop for the bathroom except when the car was low on gas. Need a potty break? Hold it or use one of Dad’s empty tennis ball cans as a makeshift port-o-potty. Dad almost always could hold it, but on the rare occasions he couldn’t, the son in the front seat had to hold his tennis can until we stopped for gas. Day one of the drive was always the same – 770 miles from Long Island to the Santee, SC Ramada Inn. 13 hours or so. We typically got three bathroom stops.

Dad also believed that cars were meant to be driven. Forever. By year 10, about 30% of the VW floor had corroded away…to the point that our feet would get wet when dad drove over a puddle. Of course, wet feet were preferable to the near frostbite on our toes during NY’s cold winters. Also, the brake pedal would not pop back up after being depressed. So, Dad tied a rope to it, and would pull it back to the “upright” position after every red light.

Thankfully, some level of sanity came back into our lives when I was 13, after my dad met our future stepmom, Patti. Realizing that no respectable woman would marry a guy who drove from NY to Florida in a car without a floor or working brakes, he traded in the VW for an Oldsmobile Cutlass Supreme.

I’d like to think that I inherited at least some of my dad’s work ethic. I know I certainly inherited his penchant for doing nutty things like driving 14 hours in a day. I certainly inherited his love for Disney. The trip with my kids (and two of Cole’s best friends) is just the latest of a series of trips we have been doing for the past 15 years. The trips are always timed with the Raymond James Summer Conference, which conveniently takes place in Orlando. I’d always promised the kids that during their graduation summer, we would do a blowout theme park trip right after the conference - incorporating Disney and Universal Studios. As luck would have it, Raymond James decided to host 2023’s conference in Dallas. I offered the kids a trip to the JFK museum instead of the theme parks, but that didn’t fly, so off we went to Orlando.

The trip was super fun, but also somewhat grueling. Always wanting to get my “money’s worth” – I insisted that we go at theme park opening each day, when the parks were empty. We stayed until park close each night, through a few rainstorms. My dad always loved mid-day rains at the theme parks, because the “candy asses” would go back to their hotels, leaving much shorter lines. For the record, “candy ass” was my dad’s favorite dismissive term for anyone who wasn’t “tough” (i.e., couldn’t go four hours in a car without peeing or essentially work 7 days a week for 40 years straight).

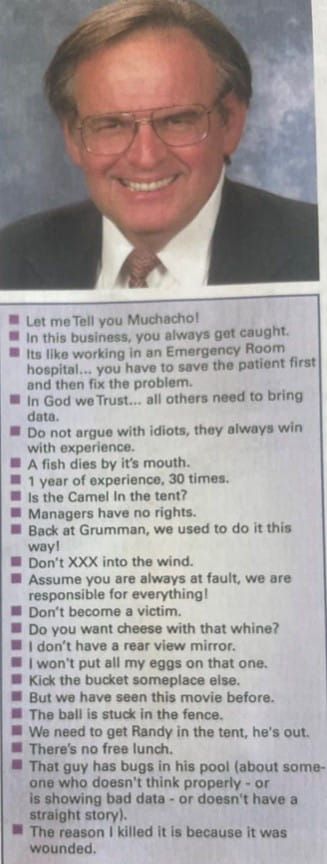

In October 2002, my dad died of a heart attack at 4 AM on his way to a meeting. The US was in the heart of the second Gulf War and the government was ordering an F/A1-8 per week, vs. the normal one per month. I took some comfort in knowing that he died doing what he loved. When I went to clean out Dad’s office, I realized that I had never seen where he worked in my entire life. Dad was notoriously secretive about his work and took his security clearances seriously. Northrup Grumman published a lovely article about him in the company newsletter, where I learned that he was renowned for his “catchphrases” – something that, according to our team, I am known for as well. I guess we all carry a little bit of our parents with us…some more than others.

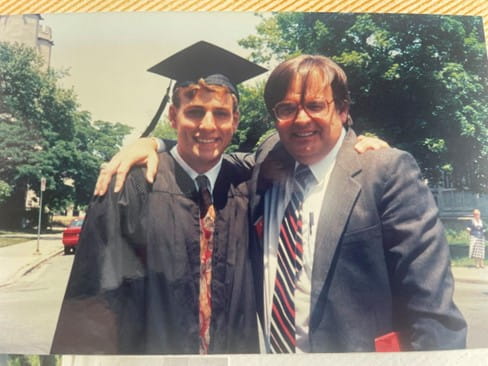

I have enclosed a few pictures of graduations and my dad’s catchphrases, though I fear they are not all politically correct! I hope all the Fathers out there have a wonderful Father’s Day…and for those of you who are lucky enough to have your Fathers with you, I hope you have time to share a hug or a meal with them…just hopefully not a tennis can!

– Bruce Cacho-Negrete

Bruce and his dad at Graduation

Catchphrases

Sincerely,

Margaret C. Starner

Senior VP - Financial Planning

2333 Ponce de Leon Blvd. Suite 500

Coral Gables, FL 33134

www.starnergroup.com

BARRON'S Hall Of Fame Advisor - inducted in 2019

Barron’s 2023 Top 1200 Financial Advisor

2023 Forbes TOP 250 Wealth Advisor list

2023 Forbes TOP WOMEN Wealth Advisor list

2023 Forbes BEST-IN-STATE Wealth Advisor list

BARRON’S Top 100 Women Financial Advisors - 2022

Investment News - 2020 Lifetime Achievement in

Excellence in Diversity & Inclusion Award

Barron’s is a registered trademark of Dow Jones & Company, L.P. All rights reserved. "Barron's Hall of Fame" is an award honoring a group of advisors who exemplify long-term success and commitment to their clients. Each member of the Hall of Fame has appeared in 10 or more of Barron's annual Top 100 Advisor rankings, and their long-looking commitment to excellence is a hopeful example for the industry to follow. The Top 100 Advisor rankings are based on data provided by individual advisors and their firms and include qualitative and quantitative criteria. Data points that relate to quality of practice include professionals with a minimum of 7 years financial services experience, acceptable compliance records (no criminal U4 issues), client retention reports, charitable and philanthropic work, quality of practice, designations held, offering services beyond investments offered including estates and trusts, and more. Financial Advisors are quantitatively rated based on varying types of revenues produced and assets under management by the financial professional, with weightings associated for each. Investment performance is not an explicit component because not all advisors have audited results and because performance figures often are influenced more by clients’ risk tolerance than by an advisor’s investment picking abilities. The ranking may not be representative of any one client’s experience, is not an endorsement, and is not indicative of advisor’s future performance. Neither Raymond James nor any of its Financial Advisors pay a fee in exchange for this award/rating. Barron’s is not affiliated with Raymond James.

Nominees for the 2020 InvestmentNews Diversity & Inclusion Lifetime Achievement Award must currently be working as financial planners, registered representatives or registered investment advisers, or as industry professionals in a role that supports financial advisers. Judges will consider management, team development, achievement and a minimum 15-year commitment to fostering diversity and inclusion. InvestmentNews received about 130 nominations for the Diversity & Inclusions awards and selected 1 individual for the Lifetime Achievement award. The ranking may not be representative of any one client's experience, is not an endorsement, and is not indicative of future performance. Neither Raymond James nor any of its Financial Advisors pay a fee in exchange for this award/rating nor is Raymond James affiliated with InvestmentNews.

The Forbes ranking of America’s Top Women Wealth Advisors, developed by SHOOK Research, is based on an algorithm of qualitative and quantitative data, rating thousands of wealth advisors with a minimum of seven years of experience and weighing factors like revenue trends, assets under management, compliance records, industry experience and best practices learned through telephone and in-person interviews. Portfolio performance is not a criteria due to varying client objectives and lack of audited data. This ranking is based upon the period from 02/04/22 to 09/30/22 and was released on 02/02/2023. Research Summary (as of February 2023): 38,314 nominations were received and 100 women won. This ranking is not indicative of an advisor's future performance, is not an endorsement, and may not be representative of individual clients' experience. Neither Raymond James nor any of its Financial Advisors or RIA firms pay a fee in exchange for this award/rating. Raymond James is not affiliated with Forbes or Shook Research, LLC. Please visit https://www.forbes.com/lists/list-directory/#1184217eb274 for more info.

Barron’s is a registered trademark of Dow Jones & Company, L.P. All rights reserved. The rankings are based on data provided by 5,630 individual advisors and their firms and include qualitative and quantitative criteria. Time period upon which the rating is based is from 09/30/2021 to 09/30/2022, and was released on 03/10/2023. Factors included in the rankings: assets under management, revenue produced for the firm, regulatory record, quality of practice and philanthropic work. Investment performance is not an explicit component because not all advisors have audited results and because performance figures often are influenced more by clients’ risk tolerance than by an advisor’s investment picking abilities. The ranking may not be representative of any one client’s experience, is not an endorsement, and is not indicative of advisor’s future performance. Neither Raymond James nor any of its Financial Advisors pay a fee in exchange for this award/rating. Barron’s is not affiliated with Raymond James.

The Forbes Top Wealth Advisors Best-In-State 2023 ranking, developed by SHOOK Research, is based on an algorithm of qualitative criteria, mostly gained through telephone and in-person due diligence interviews, and quantitative data. This ranking is based upon the period from 6/30/2021 to 6/30/2022 and was released on 4/4/2023. Those advisors that are considered have a minimum of seven years of experience, and the algorithm weights factors like revenue trends, assets under management, compliance records, industry experience and those that encompass best practices in their practices and approach to working with clients. Portfolio performance is not a criteria due to varying client objectives and lack of audited data. Out of approximately 39,007 nominations, 7,321 advisors received the award. This ranking is not indicative of an advisor's future performance, is not an endorsement, and may not be representative of individual clients' experience. Neither Raymond James nor any of its Financial Advisors or RIA firms pay a fee in exchange for this award/rating. Raymond James is not affiliated with Forbes or Shook Research, LLC. Please visit https://www.forbes.com/lists/best-in-state-wealth-advisors/?sh=181ba856ab97 for more info.

2023 Forbes America's Top Wealth Advisors, developed by Shook Research, is based on the period from 6/30/2021 to 6/30/2022 and was released on 4/4/2023. 39,007 nominations were received and 250 advisors won. Neither Raymond James nor any of its advisors pay a fee in exchange for this award. More: https://go.rjf.com/432ppOn. Please see https://www.forbes.com/top-wealth-advisors/ for more info.

Barron’s Top 100 Women Financial Advisors, (Year). Barron’s is a registered trademark of Dow Jones & Company, L.P. All rights reserved. The rankings are based on data provided by individual advisors and their firms and include qualitative and quantitative criteria. Time period upon which the rating is based is from 03/31/2021 to 03/31/2022, and was released on 06/17/2022. Data points that relate to quality of practice include professionals with a minimum of 7 years financial services experience, acceptable compliance records (no criminal U4 issues), client retention reports, charitable and philanthropic work, quality of practice, designations held, offering services beyond investments offered including estates and trusts, and more.

Financial Advisors are quantitatively rated based on varying types of revenues produced and assets under management by the financial professional, with weightings associated for each. Investment performance is not an explicit component because not all advisors have audited results and because performance figures often are influenced more by clients’ risk tolerance than by an advisor’s investment picking abilities. The ranking may not be representative of any one client’s experience, is not an endorsement, and is not indicative of an advisor’s future performance. Neither Raymond James nor any of its Financial Advisors pay a fee in exchange for this award/rating. Barron’s is not affiliated with Raymond James.